Insurers, insurtechs, vendors and brokers are challenging past practices and investing in new ways to improve customer experience. Customer experience is subjective and there are disagreements on what the ultimate customer experience looks like. Unanimously, though, most agree that it is the customer who wants it anywhere, way and when they want it.

Technology is making it easier for customers to get their insurance experience as they want it – multi-channel. The emphasis beyond that has been around self-directed insurance models, like D2C. They promise savings, ease of use and great customer experience.

Even brokers, themselves, are engaging with online self-directed portals to improve customer experience. But self-directed insurance purchasing is done at your own risk.

Insurance is not a Candy Bar or a New Car

The intangible product/service of insurance is not like a candy bar, a new car or a big screen tv. It generally won’t make someone happy no matter how much you buy or spend. It won’t make others jealous or admire you. If it was optional, most wouldn’t even buy it at all.

The experience of buying insurance is similar to taxes and death; Inevitable and unpleasant. The assumed goal for most customers is to minimize the cost of insurance (or is it?). Reinforced by most insurance marketing messages is saving you money on insurance.

Online marketers, who equate insurance buyers to eyeballs and clicks, are heavily focused on price comparison and simplified processes that appeal to the price sensitive. The dream is that a slicker online experience will “improve customer experience”.

Insurance is Different

Insurance is different and shouldn’t be sold like a candy bar or new car. While most people wouldn’t buy it if it was optional, everyone needs insurance. Unlike tangible products, where the purchase is optional, insurance is more often mandatory.

Comparing different insurance options by price is the worst way to buy or sell insurance. The most important component of insurance is what is covered and what is not covered. As with the perils of flood and earthquake, it will cost more in the areas that need it the most.

The problem is that insurance does not automatically include those perils. Self-directed purchasing insurance by price through an online portal won’t include those vital coverages. Or, even worse, the insurance purchaser may not even be given the option or know where to go for quotes on flood or earthquake insurance. It all adds up to a potential insurance coverage failure and, in some cases, catastrophe.

Insurance professionals possess knowledge that selling a policy that does not contain protection from known insurable hazards is a bad decision. Unfortunately, buying insurance directly without a broker leaves no one to blame but the buyer.

It used to be that fires were the leading cause of loss, hence, influenced the price of any policy substantially. Now, in the following example, especially, other perils are far more likely to cause substantial and possibly catastrophic loss. Yet, those perils are very likely to go uninsured in self-directed insurance.

It is like buying a car that has no tires – what is the point?

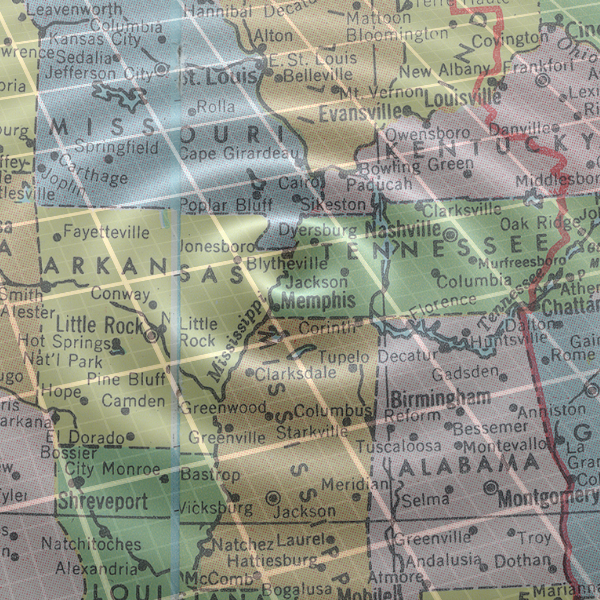

Two examples of where this may be a problem is with earthquake near St. Louis (the New Madrid Seismic Zone) and flood in Houston. See the featured stories below. In those areas not only is earthquake and flood not being purchased, at least in the case of earthquake in Missouri, it is being sold with less frequency! Yet, it remains available to purchase.

Potential causes include the self-directed websites whose version of excellent customer experience doesn’t come with the advice of an independent insurance broker or the option to purchase earthquake or flood.

I Got a Guy

Notwithstanding the ultra-price sensitive insurance buyer who only shops insurance on price alone (until an uninsured loss occurs), this next section applies to most everyone else.

For an insurance purchaser the best experience is one where you don’t have to think about insurance at all. You just have “a guy” (or person) who knows you and ensures that your interests are taken care of within your budget. They take the boring mundane task of insurance and update it as necessary.

There is a reason why P&C brokers, despite higher distribution costs, longer waiting times and accessibility, still distribute over 50% of all insurance and almost all commercial insurance. That reason is that brokers offer excellent value and “piece of mind” for an intangible product/service most people would rather not deal with at all.

Technology Can Make Brokers More Relevant

Where digital insurance marketers are focused on eyeballs and clicks, insurance brokers are woven into the fabric of the communities they serve. There is a big problem with broker distribution, but it isn’t with brokers. The problem is that it costs close to 1/3 of the total cost of insurance to distribute. Over 70% of those expenses are directly related to the manual nature of insurance for both brokers and insurers as well as the friction that the current vertical creates.

At Brokerflo, we see technology enabling brokers to perform their role better by eliminating manual tasks, enhancing the overall risk management process and speeding up the sales process in an enhanced multi-insurer environment. Reducing the business friction and manual processes will place brokers eons ahead of their competitors and

Why so few houses have earthquake insurance near Missouri’s New Madrid Seismic Zone

Missouri state officials say residents in the New Madrid Seismic Zone, which stretches along the eastern part of the state, are largely unprepared for the next major earthquake.

Earthquake insurance coverage in the highest risk area has fallen to historic lows in recent years.

Only about 12% of homes in the six-county region near the southeastern tip of Missouri have earthquake insurance, a dramatic decline compared to 2000, when about 60% of homes had coverage. Meanwhile, insurance costs have skyrocketed by 760% during that time, according to a report by the Missouri Department of Commerce and Insurance.

Carrie Couch, director of the department’s consumer affairs division, said the cost of earthquake insurance is high because there aren’t enough people buying the coverage.

“I don’t think they understand that the coverage has to be purchased separate from your homeowners or renters policy,” she said. “It’s been a while since there’s been an earthquake of any significance, so it’s not in the forefront of folks’ minds. They’re thinking about other things right now, like COVID.”

St. Louis Public Radio | By Corinne Ruff

Published February 7, 2022 at 5:24 AM CST

Why 85% of Houston homeowners have no flood insurance

Tens of thousands of people have been displaced in Houston, Texas alone by Hurricane Harvey. The long-term damage from the catastrophic flooding engulfing the US’s Gulf Coast is expected to cost companies, small businesses, and homeowners as much as $100 billion, according to Imperial Capital. The insurance industry alone may pay out $10-$20 billion, JP Morgan estimates.

While big corporations will probably survive the hit, many individual homeowners in Houston could be forced into debt or bankruptcy because they don’t have flood insurance. That’s despite the fact that scientists have been warning for years that unchecked development and climate change could cause severe flooding in Houston.

“There are some early indications that this is going to have an exceptionally large impact on the number of people who are totally uninsured,” says Howard Mills, the global insurance regulatory leaders at consulting and accounting firm Deloitte.

“Those folks will be eligible to receive small amounts of disaster assistance, but it won’t be enough to rebuild their home or help them move somewhere safe, or elevate their home,” said Rob Moore, a senior policy analyst on water issues for the Natural Resources Defense Council. “These people are in a situation that no one wants to find themselves in.”

While consumer groups and news outlets in Texas have recommended that homeowners buy flood insurance in recent years, not many have. People may not know they don’t have it, or may have decided it’s just too expensive, says Sam Friedman, the insurance research leader for the Deloitte Center for Financial Services. “They don’t want to make the investment,” he said, and they rationalize that a major flood is unlikely to happen to them.

Why 85% of Houston homeowners have no flood insurance – By Heather Timmons 29, 2017