Customer engagement is an ongoing issue for the insurance industry. As Monstarlab’s Engagement Director of Banking, Insurance and FS, David Titterton puts it; “This is partly due to consumers being less engaged with insurance products until an immediate need presents itself…” – (InsurTech Magazine – August 7, 2023)

About Customer Engagement in Insurance

In personal lines, customer engagement is a difficult objective to achieve. “Churn” is inevitable as the industry aggressively pushes customers toward believing that price is the key decision factor. Every broker, vendor, insurer is pushing customers to self-serve portals where customer service is limited (cost control) and price is the main feature (forget about coverage). The churn is created by unengaged customers continuously seeking better prices and shopping around more frequently. The cost of marketing in this environment is incredibly high because of having to continuously attract new customers.

On the other hand, commercial insurance customers are far more willing to shop through an insurance broker. Thus, giving brokers a valuable advantage in engaging those customers. In fact, independent brokers distribute over 75% of commercial insurance. According to the Insurance Information Institute, that % has actually increased over the last 5 years[1].

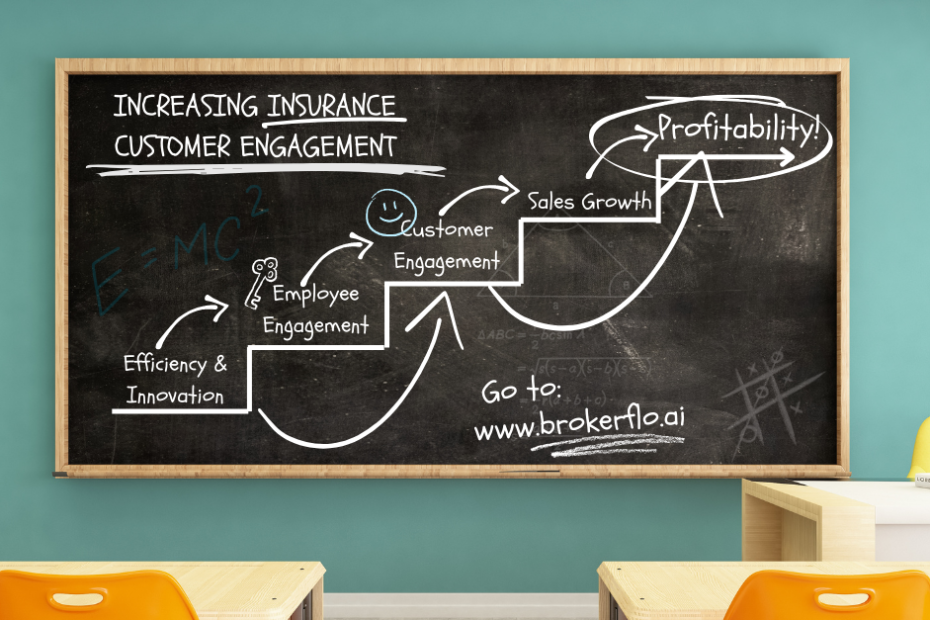

The singular advantage for engaging customers for brokers is employees. Coincidentally, commercial insurance brokers have an enormous advantage if employees, themselves, are engaged, according to Harvard Business Review (Engaged Employees Create Better Customer Experiences – April 5, 2023).

In fact, there are so many studies that continue to prove this connection between happy (engaged) employees and happy customers:

“How Happy Employees Make Happy Customers” Forbes Leadership Strategy by Shep Hyken May 27, 2017

“Happy Employees Create Happy Customers” Entrepreneur by Priyanka Mittal September 30, 2020

There are many more examples going back decades. The connection between happy employees and happy customers is undeniable.

Why You Really Want Happy Customers

Why do you want happy (engaged) customers? Here are the top reasons:

- Repeat buyers. Insurance is a multi-product every year purchase. The cost of getting a new customer is far greater than the cost of keeping existing customers.

- Increase sales – Your best sales person is a happy customer. Insurance doesn’t possess the same intrinsically fulfilling attributes as tangible products. However, when you have engaged customers, you have a powerful word of mouth marketing machine that doesn’t stop working. A memorable commercial from the ‘80’s – “And they told 2 friends” Fabergé Organics shampoo illustrates how this works.

- Profit & Growth. Having an engaged customer base is not only a low-cost but also very effective way of increasing both growth and profitability.

Creating Happy and Engaged Insurance Customers

The first step is understanding what makes an insurance customer happy and keeps them engaged. Here is a quick look at how to make insurance customers happy. Insurance customers aren’t seeking to understand more about insurance, they want to be protected against loss and get good value for that protection. Otherwise, they would just as soon not think about insurance as they have other more enjoyable things to spend their time thinking about.

Here are some things for brokers to strive to do to create happy and engaged insurance customers:

- Correct property valuations on all insured property including commercial buildings, residential buildings and equipment on new accounts and on every renewal account

- Annual coverage review with recommendations

- Going beyond insurance and offering loss control and risk management advice

- Multiple quotes from different insurers with coverage comparisons and recommendations

- Proactively remarketing accounts annually to ensure that the client is getting good value for their money

- Handling all coverage needs efficiently

Finally, as discussed, the best way for brokers to engage their customers is to engage their employees. Engaged employees = engaged customers leading to growth and profitability. With current tools for brokers, it is not possible to accomplish items 1 to 6. Most brokers are too mired in the tedium of daily paper pushing. Technology can remove the tedium to let brokers be brokers and not paper pushers. It can also accomplish 1 through 6 for every account.

“Delivering delightful customer experiences in insurance…”

Delivering delightful customer experiences in insurance is not an easy task. Brokerflo’s powerful technology stack provides brokers not only breakthrough tools to benefit and engage customers but makes their jobs easier by removing mundane tasks that allow them to become fully engaged employees.

Maximize Technology Investment For Customer Engagement

Technology investment for brokers should be about improving the broker experience AND the customer experience (engagement). NOT replacing the broker experience and losing the most valuable resource for customer engagement brokers have, the broker.

[1] https://www.iii.org/fact-statistic/facts-statistics-distribution-channels